Introduction

Briefly

Welcome to Pivo Payment API Reference!

Pivo Payment service is a Payment Gateway enabling merchants to create payment orders and receive a confirmation from consumer’s payment transaction.

In technical sense we provide two different API: Pivo Rest API with OAuth or signature authentication and Form Post API with a signature authentication.

We support mobile and web payments: mobile initiated payment order is available in Rest API and web initiated payment order is supported by both APIs.

This documentation helps You to integrate Your service to Pivo Payment.

Pivo Payment API should only be used in server to server scenarios.

Terminology

Listed terms we are using in our Payment API.

| Term | Explanation |

|---|---|

| You | The customer who is using the API. |

| We | Pivo Payment API. |

| Merchant | Merchant or Brand from where User is paying |

| Payment Order | Detailed payment order information from You. |

| Transaction | The event of money being transferred from payer to payee. |

| Payer | The person who is using Your service, the person whose money will be transferred to the payee. |

| Payee | The entity who receives payer’s money. |

| User | The person who is using Your service and Pivo. |

Examples

Please note that the presented example data is not valid (e.g iban numbers, iban owners and card tokens)

Character encoding

We use UTF-8 in all requests and responses.

Automatic Callback

Pivo calls Your web site when a successful payment transaction is done. A dedicated server to server call is done to return_url along with payment transaction details.

The call will follow redirects.

For more information regarding the request parameters see section Form Post API > Success URL

⚠ In case the Automatic callback is not as quick as You wish, You can query REST API - Payments > Get Payment Order Information which gives You fast access to Payment Order status (Additionally this also omits the need to implement callback signature calculation).

Mobile or Web Payment Order

You can provide both web urls (return_url) and app url (return_app_url) to payment orders (REST API > Create a Payment Order or Form Post API), and choose later whether to use mobile or web initialization.

Either web urls or app url is required to be present.

⚠ Please note that if return_url is present then cancel_url and reject_url are also required.

REST API

Mobile Application Initiated Payment Order

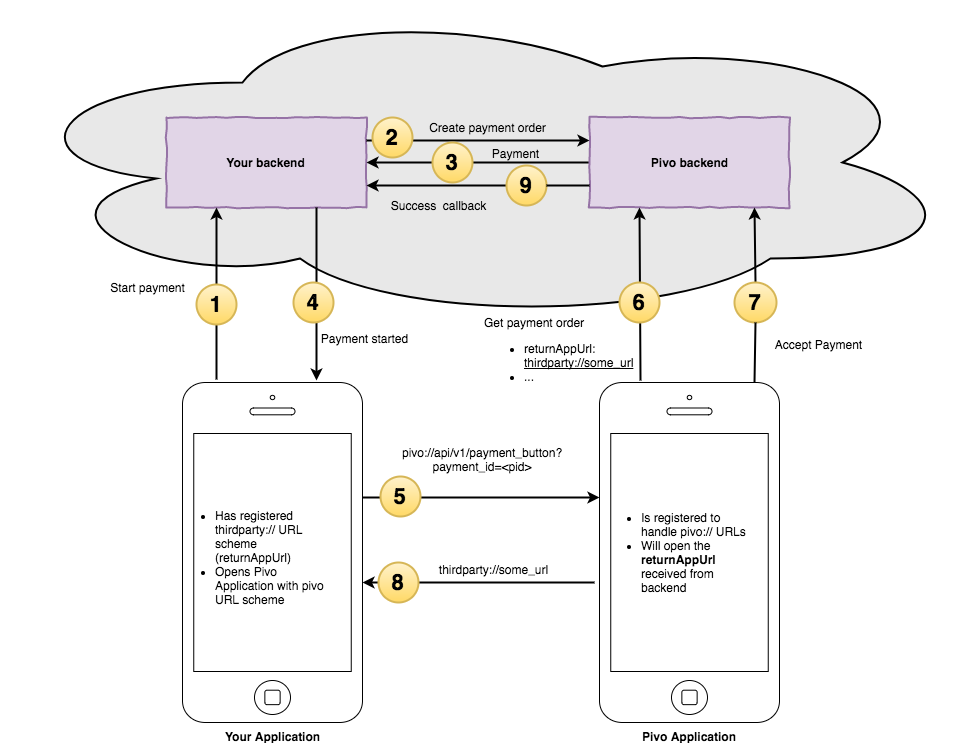

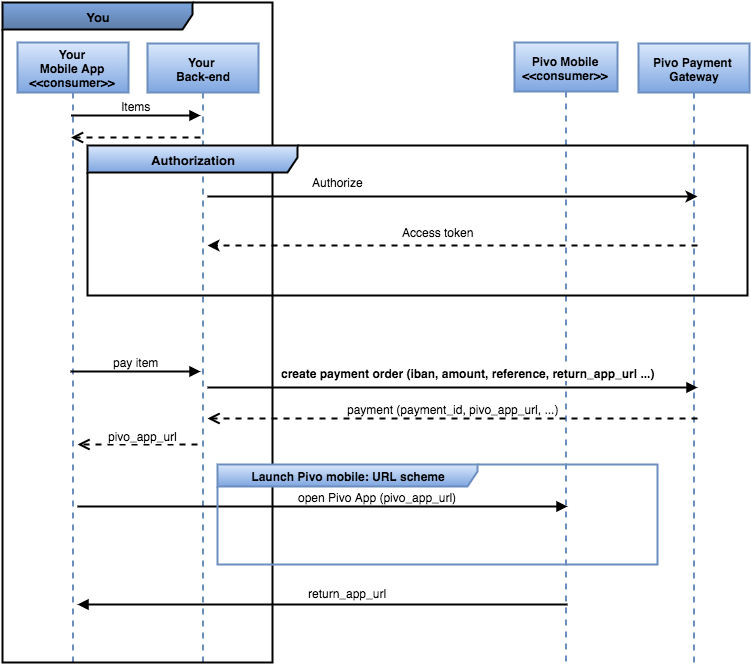

Pivo allows Third Party applications and services to launch Pivo Mobile Application with a Pivo scheme.

The following diagrams gives detailed information how Pivo handles the mobile payment process.

Restriction

Siirto payment method does not support Mobile App Switch.

Pivo creates and forwards payment orders to Siirto pipeline to notify incoming payment request for a User. return_app_url is omitted during the process.

Communication

To enable Mobile App Switch You need to create the Payment Orders with return_app_url.

Sequence

To create a Payment Order You need access to Pivo Payment API.

Pivo Loyalty program

When You want to provide seamless user experience with Pivo or You want to provide mobile payments without Your own mobile application for You users, You can integrate Your web service to Pivo as a Merchant Loyalty Program.

Your loyalty programs appears to Pivo and it is available for users using Pivo Mobile Application. Contact us to create a loyalty program.

Loyalty program landing page (callback landing url)

Your loyalty program provides a custom web ui for Pivo. When Pivo user chooses to see Your loyalty program, Pivo mobile application will render your web ui.

Pivo Mobile will sent pivo_user_token to Your site.

Loyalty program user identity federation and subscription

Resolve Pivo user identity:

Steps to follow:

- Let user to choose ‘identify’ or ‘subscribe’

- Generate unique stamp (e.g. a78dbd25-844b-49b4-b883-a544df95f8bf)

- Generate callback landing url to Your site with the unique stamp for Pivo mobile application (e.g. ‘https://yourwebsite.com/orders/a78dbd25-844b-49b4-b883-a544df95f8bf’)

- Generate return app url with urls api (by default set platform: pivo and url: generated callback landing url)

- Create Payment Order with

stampand set generated return app url asreturn_app_urldefine payment order as identification (type:identification, REST API - User identication) - Let Pivo mobile application to receive http redirect (302 Found) with location set as payment_order.pivo_app_url (e.g.

pivo://api/v1/payment_button?payment_id=50d295f3400db23b8f9b7b906ac2997ed30112bc3393e1a284cf84940e90798f) - Pivo mobile application opens and user sees Authorize Your loyalty program view.

- After a successful authorization Your web site receives Automatic callback confirmation (see section Introduction > Automatic Callback)

- User’s Pivo mobile application returns to the

return_app_url

After successful authorization and callback confirmation you can request user identity from the REST API - Users

After You have received user identity, Your web ui can assign a pivo_user_token cookie for Pivo application, which is used to identify user in subsequent calls.

⚠ In case Pivo mobile application is not following the schema redirects, please disable turbolinks or other navigation optimization solutions which modify the page structure.

Mobile Payments Without Your Own Application

To let Pivo Mobile Application to handle Your loyalty program payments, You need to create the Payment Order with a special ‘return_app_url’ and return http redirect for Pivo client.

Steps to follow:

- Let user to choose the product

- Generate unique stamp (e.g. a78dbd25-844b-49b4-b883-a544df95f8bf)

- Generate callback landing url to Your site with the unique stamp for Pivo mobile application (e.g. ‘https://yourwebsite.com/orders/a78dbd25-844b-49b4-b883-a544df95f8bf’)

- Generate return app url with urls api (by default set platform: pivo and url: generated callback landing url)

- Create Payment Order with your ‘stamp’ and set generated return app url as ‘return_app_url’

- Let Pivo mobile application to receive http redirect (302 Found) with location set as payment_order.pivo_app_url (e.g. ‘pivo://api/v1/payment_button?payment_id=50d295f3400db23b8f9b7b906ac2997ed30112bc3393e1a284cf84940e90798f’)

- Pivo mobile application opens and user sees Accept payment view.

- After a successful payment a payment receipt view is shown in Pivo mobile application and Your web site receives Automatic callback confirmation (see section Introduction > Automatic Callback)

- User clicks the close button and Pivo mobile application returns to the ‘return_app_url’

⚠ In case Pivo mobile application is not following the schema redirects, please disable turbolinks or other navigation optimization solutions which modify the page structure.

Closing view

When loyalty program needs to provide a close view for User a specific url scheme can be used. The Pivo Application closes the current loyalty program view and guides user back to Pivo Application main view.

Either http redirect

- Let Pivo mobile application to receive http redirect (302 Found) with location set as ‘pivo://api/v1/close/current_page’

or a link click event can be used to fire the wanted behaviour.

- Render a html link Back to pivo main screen with the schema

<a href="pivo://api/v1/close/current_page">Back to pivo main screen</a>

Web Browser Initiated Payment Order

Pivo provides a dedicated landing page with user instructions to pay Your payment order.

After a successful payment order creation redirect User’s web browser to location_url. In case of a mobile browser, the Pivo mobile application is tried to open automatically. For desktop browser’s we enquire user to fill a phone number, which will notify Pivo mobile application with a push notification.

After a successful payment transaction, the browser returns to Your web site with payment transaction details (additionally see Automatic Callback for server callback).

REST API - Authorization

Pivo Payment API relies on OAuth2 Client Credentials Grant Authorization.

Subsequent resource API calls require an access token, which can be established with provisioned client credentials.

To use resources You need to request specific access request scope when creating access token (e.g. payments)

Don’t leak Your OAuth client secret to users nor mobile applications.

Getting an Access Token

POST https://qa-maksu-api.pivo.fi/oauth/token

Getting an Access Token with Your credentials.

A successful response contains the access token.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/oauth/token" -d '{"client_id":"payment_api_user","client_secret":"30713f017cf49f1cde8c058446273d02ef040548178a89c050c7aff357729178","scope":"payments acquirings","grant_type":"client_credentials"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Request body:

{

"client_id": "payment_api_user",

"client_secret": "30713f017cf49f1cde8c058446273d02ef040548178a89c050c7aff357729178",

"scope": "payments acquirings",

"grant_type": "client_credentials"

}

Response with status 200:

{

"access_token": "9de58b14e0115eb86e970eea44d7a4368787f132f1a77fd6e2ed4a2c5adeae57",

"token_type": "bearer",

"expires_in": 7200,

"scope": "payments acquirings",

"created_at": 1544611484

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| client_id | true | String | The client id |

| client_secret | true | String | The client secret |

| scope | true | String | The scope of the access request. E.g. ‘payments’ |

| grant_type | true | String | Type of the scope. Use ‘client_credentials’ |

Response Fields

| Name | Type | Description |

|---|---|---|

| access_token | String | The access token |

| token_type | String | Type of the token |

| expires_in | Integer | Expire time of access token in seconds |

| scope | String | OAuth scope of the session |

| created_at | Integer | Unix timestamp of creation time |

REST API - Acquirings

Used to create Merchant acquiring data.

Acquiring defines merchant’s financial contact information as a Payment method (aka. payment type) for Pivo user.

Currently we support bank_account, payment card and siirto payment methods.

To support bank account, You need a bank account number from bank contract. To support card payments, You need credit card merchant agreement details from payment card contract. To support siirto, You need a siirto id from Pivo.

Based on Your business needs you can create a single acquiring defining all payment methods or separate acquirings for each payment method.

When creating acquiring, You can provide

- bank account information (

ibanandiban_owner_name) - new payment card data (

card_provider_account,card_provider_merchant,card_provider_key, andcard_provider_secret) - previously created card merchant token (

card_merchant_token) - siirto (

siirto_idandsiirto_business_idin international format)

If iban is provided then iban_owner_name field is mandatory.

When creating new card information (merchant token) all card_provider* fields are required.

Pivo uses Payment Highway (PH) Client Credentials Share for card payments. This feature enables sharing Pivo tokenized payment cards with third party Payment Highway merchants.

When siirto_id is provided then siirto_business_id is mandatory.

Access scope: acquirings

To use this resource You need to request specific access scope when getting access token.

List Acquirings

GET https://qa-maksu-api.pivo.fi/api/acquirings

cUrl Example:

$ curl -g "https://qa-maksu-api.pivo.fi/api/acquirings" -X GET \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 38f9e1ffe8dcbf016ccd8ff41face519e438b4c7e490cb72d6500cafa5285303

Response with status 200:

{

"acquirings": [

{

"acquiring_id": "390caffdf182b56366cfe0b2c5c6e3ad970d1b9e4c838f906ca20d9a9f8ba4e6",

"payment_methods": {

"account": {

"iban": "FI2112345600000785",

"iban_owner_name": "Test Iban owner"

},

"card": {

"merchant_token": "Test Merchant token"

}

}

}

]

}

Query Parameters

| Name | Required | Type | Description |

|---|

None

Response Fields

| Name | Type | Description |

|---|---|---|

| acquirings | JSON list | Created acruiring object |

| acquiring_id | String | Unique Acquiring identifier |

| payment_methods | JSON object | Object containing methods od payment |

| account | JSON Object | Object containing information about bank account |

| iban | String | Payee IBAN number |

| iban_owner_name | String | Payee name |

| card | JSON Object | Card information |

| merchant_token | String | Merchant credit card token |

| siirto | JSON Object | Siirto information |

| siirto_id | String | Your Siirto id |

| siirto_business_id | String | Your business id in international format (e.g. FI22410078) |

Create Acquiring with bank account information

POST https://qa-maksu-api.pivo.fi/api/acquirings

A successful response contains information about the created acquiring data.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/acquirings" -d '{"iban":"FI2112345600000785","iban_owner_name":"Pivo Wallet Oy"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer ce41f89e4518cc3d51efc5f6c826cfd49ae678b05d5f2d98fa91e6e4845a547c

Request body:

{

"iban": "FI2112345600000785",

"iban_owner_name": "Pivo Wallet Oy"

}

Response with status 200:

{

"acquiring_id": "5aefc10a88ffc85cc0c5f9fa8f01c715e3e5ff0ac666db2ffd6ac6f1dddce993",

"payment_methods": {

"account": {

"iban": "FI2112345600000785",

"iban_owner_name": "Pivo Wallet Oy"

}

}

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| iban | true | String | IBAN number |

| iban_owner_name | true | String | IBAN owner name |

Response Fields

| Name | Type | Description |

|---|---|---|

| acquiring_id | String | Unique Acquiring identifier |

| payment_methods | JSON object | Object containing methods of payment |

| account | JSON Object | Object containing information about bank account |

| iban | String | Payee IBAN number |

| iban_owner_name | String | Payee name |

Create Acquiring Data with previously created card merchant token

POST https://qa-maksu-api.pivo.fi/api/acquirings

A successful response contains information about the created acquiring data.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/acquirings" -d '{"card_merchant_token":"b8a11e6de4e73a704456255423b192dd847adc0277ddee26a454921cdbbe0bd1"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer ea0a86c5e251c70d1419939d424fca3d2a9da6b6041753b0cd7205b697de851c

Request body:

{

"card_merchant_token": "b8a11e6de4e73a704456255423b192dd847adc0277ddee26a454921cdbbe0bd1"

}

Response with status 200:

{

"acquiring_id": "c0492f14d30abe4e2f82e8dff02d3604e91223485091a15f314eb27d8c881fc3",

"payment_methods": {

"card": {

"merchant_token": "b8a11e6de4e73a704456255423b192dd847adc0277ddee26a454921cdbbe0bd1"

}

}

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| card_merchant_token | true | String | Your previously created card merchant token |

Response Fields

| Name | Type | Description |

|---|---|---|

| acquiring_id | String | Unique Acquiring identifier |

| payment_methods | JSON object | Object containing methods od payment |

| card | JSON Object | Card information |

| merchant_token | String | Merchant credit card token |

Get acquiring info

GET https://qa-maksu-api.pivo.fi/api/acquirings/:acquiring_id

cUrl Example:

$ curl -g "https://qa-maksu-api.pivo.fi/api/acquirings/b69ace8e37cafe56d1f3e6c11cd59fef8bdd921951cf031e4dd2d6361888de5e" -X GET \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 7800776d23822ae4d8f8afbaf7027380b18a0942000e15f4223ed27894b63fbb

Response with status 200:

{

"acquiring_id": "b69ace8e37cafe56d1f3e6c11cd59fef8bdd921951cf031e4dd2d6361888de5e",

"payment_methods": {

"account": {

"iban": "FI2112345600000785",

"iban_owner_name": "Test Iban owner"

},

"card": {

"merchant_token": "Test Merchant token"

}

}

}

Query Parameters

| Name | Required | Type | Description |

|---|

None

Response Fields

| Name | Type | Description |

|---|---|---|

| acquiring_id | String | Unique Acquiring identifier |

| payment_methods | JSON object | Object containing payment methods |

| account | JSON Object | Object containing information about bank account |

| iban | String | Payee IBAN number |

| iban_owner_name | String | Payee name |

| card | JSON Object | Card information |

| merchant_token | String | Merchant credit card token |

| siirto | JSON Object | Siirto information |

| siirto_id | String | Your Siirto id |

| siirto_business_id | String | Your business id in international format (e.g. FI22410078) |

Create Acquiring with new payment card data

POST https://qa-maksu-api.pivo.fi/api/acquirings

A successful response contains information about the created acquiring data.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/acquirings" -d '{"card_provider_account":"your_account","card_provider_merchant":"Your Merchant Name","card_provider_key":"your_account_1","card_provider_secret":"your_very_secret_key"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer ea0ebf7b160f89a0fdb57daefb3f6e0a37dced02384c1a86ba081a4e80ae4986

Request body:

{

"card_provider_account": "your_account",

"card_provider_merchant": "Your Merchant Name",

"card_provider_key": "your_account_1",

"card_provider_secret": "your_very_secret_key"

}

Response with status 200:

{

"acquiring_id": "85a5947dc85d100ba4f636d6c6c1dd05d5965ab745ad4f30b9556b4f5e257650",

"payment_methods": {

"card": {

"merchant_token": "9eac08d7c917acacf137bfb0cfd29f15f507a0e7cc9690472e4f66d10b16451c"

}

}

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| card_provider_account | true | String | Your PH provider account |

| card_provider_merchant | true | String | Your PH provider merchant name |

| card_provider_key | true | String | Your PH technical account specific key |

| card_provider_secret | true | String | Your PH technical account specific secret |

Response Fields

| Name | Type | Description |

|---|---|---|

| acquiring_id | String | Unique Acquiring identifier |

| payment_methods | JSON object | Object containing methods od payment |

| card | JSON Object | Card information |

| merchant_token | String | Merchant credit card token |

Create Acquiring with bank account information, payment card data and siirto_id

POST https://qa-maksu-api.pivo.fi/api/acquirings

A successful response contains information about the created acquiring data.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/acquirings" -d '{"iban":"FI2112345600000785","iban_owner_name":"Pivo Wallet Oy","card_provider_account":"your_account","card_provider_merchant":"Your Merchant Name","card_provider_key":"your_account_1","card_provider_secret":"your_very_secret_key","siirto_id":"your Siirto id","siirto_business_id":"FI22410078"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 7e11113b2247ab3976166c4597293123ceb98f917e55e324755e64e310b16fbf

Request body:

{

"iban": "FI2112345600000785",

"iban_owner_name": "Pivo Wallet Oy",

"card_provider_account": "your_account",

"card_provider_merchant": "Your Merchant Name",

"card_provider_key": "your_account_1",

"card_provider_secret": "your_very_secret_key",

"siirto_id": "your Siirto id",

"siirto_business_id": "FI22410078"

}

Response with status 200:

{

"acquiring_id": "fe03936ed2a67a2012694dc7b25ded60569bd2a939c76671042c7f47de2d27c5",

"payment_methods": {

"account": {

"iban": "FI2112345600000785",

"iban_owner_name": "Pivo Wallet Oy"

},

"card": {

"merchant_token": "2954fe718c8d545cde328a56fd75e7ce86b45a6c8bd2e0fef27411edbb322ca1"

},

"siirto": {

"siirto_id": "your Siirto id",

"siirto_business_id": "FI22410078"

}

}

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| iban | true | String | IBAN number |

| iban_owner_name | true | String | IBAN owner name |

| card_provider_account | true | String | Your PH provider account |

| card_provider_merchant | true | String | Your PH provider merchant name |

| card_provider_key | true | String | Your PH technical account specific key |

| card_provider_secret | true | String | Your PH technical account specific secret |

| siirto_id | true | String | Your Siirto id |

| siirto_business_id | true | String | Your business id in international format (e.g. FI22410078) |

Response Fields

| Name | Type | Description |

|---|---|---|

| acquiring_id | String | Unique Acquiring identifier |

| payment_methods | JSON object | Object containing methods od payment |

| account | JSON Object | Object containing information about bank account |

| iban | String | Payee IBAN number |

| iban_owner_name | String | Payee name |

| card | JSON Object | Card information |

| merchant_token | String | Merchant credit card token |

| siirto | JSON Object | Siirto information |

| siirto_id | String | Your Siirto id |

| siirto_business_id | String | Your business id in international format (e.g. FI22410078) |

REST API - Payments

Create, view and cancel payment orders.

An Acquiring is required before payment order can be created.

Please see section Mobile or Web Payment Order whether to provide return_url and/or return_app_url parameters.

Access scope: payments

To use this resource You need to request a specific access scope when getting access token.

Typical Error Codes

Error codes 4xx are client errors. On an error, please check Your parameters and access token.

| Error Code | Message | Meaning |

|---|---|---|

| 400 | Bad Request | Parameters are invalid or malformed |

| 401 | Unauthorized | No access token provided or the access token is invalid. Signature is not correct. |

| 403 | Forbidden | The access token does not have proper scope |

| 404 | Not Found | The payment does not exist |

Parameter maximum length

When maximum size of the parameters (merchant_name, message) are met, parameters will be truncated (shortened to maximum size).

Canceling a Payment Order

DELETE https://qa-maksu-api.pivo.fi/api/payments/:payment_id

Cancels the the payment order. No data is returned on successful response.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843" -d '' -X DELETE \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer dbb01f0fb9128b0a0ec71363894949dbe373f9c36907bd216138a30460170895

Response with status 200:

Query Parameters

| Name | Required | Type | Description |

|---|

None

Response Fields

| Name | Type | Description |

|---|

None

Refunding a Payment Order

POST https://qa-maksu-api.pivo.fi/api/payments/:payment_id/refund

Refunds the paid payment. Supports full and partial refunds.

⚠ Please note that this API is restricted! For more information please contact us. (access right refund)

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/payments/fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e/refund" -d '{"reference":"14932116599460307792","amount":21,"nonce":"0f29fcaf3562978cb9d133a5bcba0281ba231d193f79b29f482b721e44639fd3","stamp":"509d3412-51bc-4d9a-942f-6fdf42751855","merchant_acquiring_info":"card for-card-provider"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer 0f29fcaf3562978cb9d133a5bcba0281ba231d193f79b29f482b721e44639fd3

Request body:

{

"reference": "14932116599460307792",

"amount": 21,

"nonce": "0f29fcaf3562978cb9d133a5bcba0281ba231d193f79b29f482b721e44639fd3",

"stamp": "509d3412-51bc-4d9a-942f-6fdf42751855",

"merchant_acquiring_info": "card for-card-provider"

}

Response with status 200:

{

"payment_id": "fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e",

"stamp": "a15428a8-9801-44d9-99f8-545458b2473f",

"refund": {

"stamp": "509d3412-51bc-4d9a-942f-6fdf42751855",

"reference": "14932116599460307792",

"amount": 21,

"archive_id": "0f29fcaf3562978cb9d133a5bcba0281ba231d193f79b29f482b721e44639fd3",

"payment_type": "account",

"created_at": "2018-12-12T10:44:44Z"

}

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| reference | false | String | Refund’s reference number in standard format (viite). |

| amount | false | Integer | Refund amount in euro cents. If omitted the payment is fully refunded. |

| nonce | true | String | Parameter ‘nonce’ or request header ‘Request-Id’ is required for security. Must be unique. |

| stamp | true | String | Your unique identifier for the refund |

| merchant_acquiring_info | false | String | Additional merchant (sub-merchant) acquiring data for payment processing. Format: ‘card for-card-provider, account for-account-provider’ |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_id | String | Pivo unique identifier for the payment order. |

| stamp | String | Your unique identifier for the payment order |

| refund | JSON object | Created refund information |

| stamp | String | Unique identifier for the refund |

| reference | String | Refund reference number in standard format (viite) |

| amount | Integer | Refunded amount in euro cents. |

| payment_type | String | Payment method of the refund transaction. ‘account’: Payment order paid as Bank account transfer, ‘card’: Payment order paid as Card payment |

| archive_id | String | Refund payment transaction identification in payment system, ‘arkistointitunnus’. E.g. Bank transfer ‘20170105593497XH0002’ (arkistointitunnus), card payment ‘170125211023’ (filing_code) |

| created_at | String | Refund creation time, ISO-8601 format |

Create a Payment Order

POST https://qa-maksu-api.pivo.fi/api/payments

A successful response contains information about the created payment order.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/payments" -d '{"stamp":"7960f422-0331-400a-b384-0b4d261cebca","reference":"14932116599460307792","acquiring_id":"25df4c0080cb8f6f3f1839ce495a94f403c2a681caaa852e62eb651b72c36752","amount":350,"merchant_name":"Pivo Wallet Oy","merchant_business_id":"2241007-8","merchant_webstore_url":"https://pivolompakko.fi/","merchant_acquiring_info":"card for-card-provider","message":"It be a message.","phone":"+358402017501","return_url":"https://yourwebsite.com/callback/return","cancel_url":"https://yourwebsite.com/callback/cancel","reject_url":"https://yourwebsite.com/callback/reject","return_app_url":"yourscheme://api/return"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer 329ea89216306fe3a7a6b4d909b1ec658839f252036f7235f80e0595d6fab4e2

Request body:

{

"stamp": "7960f422-0331-400a-b384-0b4d261cebca",

"reference": "14932116599460307792",

"acquiring_id": "25df4c0080cb8f6f3f1839ce495a94f403c2a681caaa852e62eb651b72c36752",

"amount": 350,

"merchant_name": "Pivo Wallet Oy",

"merchant_business_id": "2241007-8",

"merchant_webstore_url": "https://pivolompakko.fi/",

"merchant_acquiring_info": "card for-card-provider",

"message": "It be a message.",

"phone": "+358402017501",

"return_url": "https://yourwebsite.com/callback/return",

"cancel_url": "https://yourwebsite.com/callback/cancel",

"reject_url": "https://yourwebsite.com/callback/reject",

"return_app_url": "yourscheme://api/return"

}

Response with status 200:

{

"payment_id": "9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"stamp": "7960f422-0331-400a-b384-0b4d261cebca",

"merchant_name": "Pivo Wallet Oy",

"merchant_webstore_url": "https://pivolompakko.fi/",

"merchant_business_id": "2241007-8",

"reference": "14932116599460307792",

"message": "It be a message.",

"amount": 350,

"return_app_url": "yourscheme://api/return?payment_id=9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"pivo_app_url": "pivo://api/v1/payment_button?payment_id=9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"expires_at": 1544613284,

"expired": false,

"type": "payment_order",

"created_at": "2018-12-12T10:44:44Z",

"updated_at": "2018-12-12T10:44:44Z",

"acquiring": {

"acquiring_id": "25df4c0080cb8f6f3f1839ce495a94f403c2a681caaa852e62eb651b72c36752"

},

"phone": "+358402017501",

"phone_status": "received",

"status": "pending",

"url": "",

"location_url": "http://localhost:4000/api/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"return_url": "https://yourwebsite.com/callback/return",

"cancel_url": "https://yourwebsite.com/callback/cancel",

"reject_url": "https://yourwebsite.com/callback/reject"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| stamp | true | String | Your unique identifier for the payment order |

| reference | false | String | Payment’s reference number in standard format (viite). If not present ‘message’ is used. |

| acquiring_id | true | String | Unique identifier for the acquiring data |

| amount | true | Integer | Amount in euro cents |

| merchant_name | true | String | Merchant name. Maximum length is 100 characters. Displayed in Pivo ‘approve payment’ view. |

| merchant_business_id | false | String | Merchant business id (Y-tunnus) |

| merchant_webstore_url | false | String | Merchant web store address |

| merchant_acquiring_info | false | String | Additional merchant (sub-merchant) acquiring data for payment processing. Format: ‘card for-card-provider, account for-account-provider’ |

| message | false | String | Payment related message for the user. e.g. Product summary. Maximum length is 140 characters. |

| phone | false | String | User’s phone number. Will be suggested (pre-filled) for User on desktop browser payments. The phone number needs to be in international format (e.g. +358401234567) or local format (e.g. 0401234567). |

| return_url | false | String | Success url. Called automatically by Us to confirm payment transaction. On web payments consumer’s browser is redirected to the url along with payment transaction details. If not provided, web payment is not supported (location_url is defined as blank) and no confirmation is sent. |

| cancel_url | false | String | Used on web payments when consumer cancels the payment order. User’s browser is redirected to the url along with cancellation details. |

| reject_url | false | String | Used on web payments when we cannot help consumer to pay. User’s browser is redirected to the url along with rejection details. |

| return_app_url | false | String | Used to get back to Your application. |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_id | String | Pivo unique identifier for the payment order. |

| stamp | String | Your unique identifier for the payment order |

| merchant_name | String | Name of the merchant |

| merchant_webstore_url | String | Merchant web store address |

| merchant_business_id | String | Merchant business id (Y-tunnus) |

| reference | String | Payment’s reference number in standard format (viite) |

| message | String | Payment related message for the user. e.g. Product summary. Maximum length is 140 characters. |

| amount | Integer | Amount in euro cents |

| return_app_url | String | Used to get back to Your application. |

| pivo_app_url | String | Url that You will use to open the Pivo mobile app |

| expires_at | Integer | UNIX time stamp of expiration time (seconds) |

| expired | Boolean | Tells whether the payment order is expired |

| type | String | Payment order type, ‘payment_order’ |

| created_at | String | Creation time, ISO-8601 format |

| updated_at | String | Update time, ISO-8601 format |

| phone | String | User’s phone number |

| phone_status | phone status | |

| status | String | Status of the payment order (‘pending’, ‘paid’, ‘cancelled’, ‘rejected’ or ‘refunded’) |

| url | String | Generated with call back urls when final state is given |

| location_url | String | web UI location for the payment order |

| return_url | String | Return url |

| cancel_url | String | Cancel url |

| reject_url | String | Reject url |

| acquiring | JSON object | Acquiring data |

| acquiring_id | String | Unique Acquiring identifier |

Charge payment order with charge token

POST https://qa-maksu-api.pivo.fi/api/payments/:payment_id/charge

Used to create a charge with Pivo charge token.

⚠ Please note that this API is restricted! For more information please contact us. (access right payments_charge)

Typical Error Codes

| Error Code | Message | Meaning |

|---|---|---|

| 400 | Bad request | With body {“payment_method”:“not_supported” } when Pivo user has chosen a Payment Method which is not supported by the Merchant |

| 409 | Conflict | It is possible to call charge only once with the defined charge token. Following requests will end up with conflick http response code. |

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843/charge" -d '{"charge_token":"16f325c73bb1690bbe78"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer 7da4c7895903cc064562553b83910932483acebe3ae1dbc563b61d02bbc8c7e2

Request body:

{

"charge_token": "16f325c73bb1690bbe78"

}

Response with status 200:

{

"archive_id": "20170105593497XH0002",

"payment_type": "siirto"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| charge_token | true | String | Charge token |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_type | String | Payment method of the payment transaction. ‘account’: Payment order paid as Bank account transfer, ‘card’: Payment order paid as Card payment, ‘siirto’ Payment order paid as siirto payment. |

| archive_id | String | Payment transaction identification in payment system, ‘arkistointitunnus’. E.g. Bank transfer ‘20170105593497XH0002’ (arkistointitunnus), card payment ‘170125211023’ (filing_code) |

Get all payments

GET https://qa-maksu-api.pivo.fi/api/payments

Get list of payment orders

cUrl Example:

$ curl -g "https://qa-maksu-api.pivo.fi/api/payments" -X GET \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer c1a825d8f2e78fd42c965507040e4b1fbb67c7824311554074c21ba94cb48194

Response with status 200:

{

"payments": [

{

"payment_id": "fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e",

"stamp": "350de737-b659-41af-bfb3-462eddbd6a1a",

"merchant_name": "Pivo Wallet Oy",

"amount": 121,

"status": "refunded"

},

{

"payment_id": "9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"stamp": "456dcc1b-c3a1-4184-8355-18989a7f5a8b",

"merchant_name": "Pivo Wallet Oy",

"amount": 350,

"status": "pending"

}

],

"meta": {

"current_page": 1,

"total_pages": 1,

"total_count": 2

}

}

Query Parameters

| Name | Required | Type | Description |

|---|

None

Response Fields

| Name | Type | Description |

|---|---|---|

| payments | JSON List | List containing information in payment orders |

| payment_id | String | Pivo unique identifier for the payment order. |

| stamp | String | Your unique identifier for the payment order |

| merchant_name | String | Name of the merchant |

| amount | Integer | Amount in euro cents |

| status | String | Status of the payment order (“pending”, “paid”, “cancelled”, “rejected” or “refunded”) |

| meta | JSON Object | Contains information on paging of paymebts |

| current_page | Integer | Which page of the list is |

| total_pages | Integer | Total amount of pages |

| total_count | Integer | Total amount of payment orders |

Get Payment Order Information

GET https://qa-maksu-api.pivo.fi/api/payments/:payment_id

Get payment order information with payment_id or Your stamp. Parameter :payment_id can be either Your stamp or payment_id generated by Us.

The phone_status statuses are explaned in the section Add phone number to existing payment

cUrl Example:

$ curl -g "https://qa-maksu-api.pivo.fi/api/payments/fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e" -X GET \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer 4f9d3fbfa992bc611d9380918e7b3f29eac670cb446208f16fd79b156e28bf35

Response with status 200:

{

"payment_id": "fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e",

"stamp": "de9dfa3b-2bce-4fa4-9543-e6448c25c174",

"merchant_name": "Pivo Wallet Oy",

"merchant_webstore_url": "https://pivolompakko.fi/",

"merchant_business_id": "2241007-8",

"reference": "14932116599460307792",

"message": "Another message",

"amount": 121,

"return_app_url": "yourscheme://api/return?payment_id=fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e",

"pivo_app_url": "pivo://api/v1/payment_button?payment_id=fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e",

"expires_at": 1544613284,

"expired": false,

"type": "payment_order",

"created_at": "2018-12-12T10:44:44Z",

"updated_at": "2018-12-12T10:44:44Z",

"acquiring": {

"acquiring_id": "97a94d65a3e5734a7cbca212947a4cbcc37c2556965a1c5a480e55d4b0370b7e"

},

"phone": "+358500000000",

"phone_status": "received",

"current_amount": 111,

"status": "refunded",

"url": "https://yourwebsite.com/callback/return?archive_id=9713a826311d3c9ab0e7dcf59ba99b790858b32849aa93772a6e06f7410793e1&payment_id=fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e&payment_type=account&signature=account_id+27efbd50f6720c4777d5d43c4327fc74f3ce9edc0aefb3350641d99477f99133&stamp=de9dfa3b-2bce-4fa4-9543-e6448c25c174&status=paid",

"location_url": "http://localhost:4000/api/payments/fd8bcb800ae79bf1f7b9afb137d9972f8f885dfa2256e9fa9505c3e73da4643e",

"payment_type": "account",

"archive_id": "9713a826311d3c9ab0e7dcf59ba99b790858b32849aa93772a6e06f7410793e1",

"return_url": "https://yourwebsite.com/callback/return",

"cancel_url": "https://yourwebsite.com/callback/cancel",

"reject_url": "https://yourwebsite.com/callback/reject",

"refunds": [

{

"stamp": "898585b0-dc12-4d10-96fe-380240ed2407",

"reference": "6407b8d7-04c0-4ab8-8363-cb0b824e89e2",

"amount": 10,

"archive_id": "ab60a557-08d7-458b-a3fa-6c6785303e1e",

"payment_type": "account",

"created_at": "2018-12-12T10:44:44Z"

}

]

}

Query Parameters

| Name | Required | Type | Description |

|---|

None

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_id | String | Pivo unique identifier for the payment order. |

| stamp | String | Your unique identifier for the payment order |

| merchant_name | String | Name of the merchant |

| merchant_webstore_url | String | Merchant’s web store address |

| merchant_business_id | String | Merchant business id (Y-tunnus) |

| reference | String | Payment’s reference number in standard format (viite) |

| message | String | Payment related message for the user. e.g. Product summary. Maximum length is 140 characters. |

| amount | Integer | Amount in euro cents |

| return_app_url | String | Used to get back to Your application. |

| pivo_app_url | String | Url that you will use to open the Pivo mobile app |

| expires_at | Integer | UNIX time stamp of expiration time (seconds) |

| expired | Boolean | Tells whether the payment order is expired |

| type | String | Payment order type, “payment order” |

| created_at | String | Creation time, ISO-8601 format |

| updated_at | String | Update time, ISO-8601 format |

| phone | String | User’s phone number |

| phone_status | phone status | |

| current_amount | Integer | Current amount tells the current real value of the payment order (in euro cents), calculates refunds. |

| status | String | Status of the payment order (“pending”, “paid”, “cancelled”, “rejected” or “refunded”) |

| url | String | Generated with call back urls when final state is given |

| location_url | String | web UI location for the payment order |

| payment_type | String | Payment method of the payment transaction. ‘account’: Payment order paid as Bank account transfer, ‘card’: Payment order paid as Card payment, ‘siirto’ Payment order paid as siirto payment. |

| archive_id | String | Payment transaction identification in payment system, ‘arkistointitunnus’. E.g. Bank transfer ‘20170105593497XH0002’ (arkistointitunnus), card payment ‘170125211023’ (filing_code) |

| return_url | String | Return url |

| cancel_url | String | Cancel url |

| reject_url | String | Reject url |

| acquiring | JSON object | Acquiring data |

| acquiring_id | String | Unique Acquiring identifier |

| refunds | JSON object | Refund data |

| stamp | String | Refund unique identifier |

| reference | String | Refund reference number in standard format (viite) |

| amount | String | Refunded amount in euro cents. |

| payment_type | String | Payment method of the refund transaction. ‘account’: Payment order paid as Bank account transfer, ‘card’: Payment order paid as Card payment |

| archive_id | String | Refund payment transaction identification in payment system, ‘arkistointitunnus’. E.g. Bank transfer ‘20170105593497XH0002’ (arkistointitunnus), card payment ‘170125211023’ (filing_code) |

| created_at | String | Refund creation time, ISO-8601 format |

Add phone number to existing payment

PUT https://qa-maksu-api.pivo.fi/api/payments/:payment_id/phone_number/:phone_number

Used to add phone number to an existing payment order. When You add a phone number to an existing payment order the Payer will receive a push notification referencing to the payment order.

The phone number needs to be in international format (e.g. +358401234567) or local format (e.g. 0401234567).

⚠ Please note that this API is restricted! For more information please contact us. (access right payments_phone_number)

Phone statuses

| phone_status | Explanation |

|---|---|

| received | Phone number is received along with other payment order creation data |

| prosessing | in process (set phone number has called and a Payment notification is sent) |

| ok | Pivo user did not receive push notification |

| push | Pivo user received a push notification |

| siirto | Payment notification was sent to Siirto. |

| accepted | Pivo user was not found, Nor registered device in Siirto, but the created payment order is waiting for user to register with the given phone number. |

| error | Processing failed (Recreating the initiated call might help) |

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843/phone_number/%2B358401234567" -d '' -X PUT \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "Api-Version: 2"

Request Header:

Accept: application/json

Content-Type: application/json

Api-Version: 2

Authorization: Bearer c88065b930795f5d82b39897524a68aea7e6ab03f6b473f11a1c5d36a3d67595

Response with status 200:

{

"phone_status": "ok"

}

Query Parameters

| Name | Required | Type | Description |

|---|

None

Response Fields

| Name | Type | Description |

|---|---|---|

| phone_status | phone status |

REST API - Urls

Used to create urls for payment order and share when Pivo mobile application is used.

When generating return_app_url to payment order the target platform is pivo.

when generating share able link the target platform is http.

Access scope: urls

To use this resource You need to request a specific access scope when getting access token.

Create Loyalty program url for pivo platform

POST https://qa-maksu-api.pivo.fi/api/urls/loyalty_program_site

Response contains the generated url and used platform

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/urls/loyalty_program_site" -d '{"platform":"pivo","url":"https://yourwebsite.com/orders/a78dbd25-844b-49b4-b883-a544df95f8bf"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer fc2a7335c14b4e88066810a0c449776ec16bec14c1778ef582b32114134a222a

Request body:

{

"platform": "pivo",

"url": "https://yourwebsite.com/orders/a78dbd25-844b-49b4-b883-a544df95f8bf"

}

Response with status 200:

{

"platform": "pivo",

"url": "pivo://api/v1/open/loyalty_program_site?url=https://yourwebsite.com/orders/a78dbd25-844b-49b4-b883-a544df95f8bf&pivo_loyalty_program=example_pivo_loyalty_program_name"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| platform | true | String | Target platform. (“pivo” or “http”) |

| url | true | String | Loyalty program landing url. Fully qualified url with protocol, host and path. |

Response Fields

| Name | Type | Description |

|---|---|---|

| platform | String | Target platform to which the generated url was created |

| url | String | Generated url |

REST API - User identification

Create a Pivo user identification request

Please read Pivo Loyalty program for more information regarding Pivo integration.

Access scope: payments

To use this resource You need to request a specific access scope when getting access token.

Additionally We need to grant Your account a specific payments_type permission.

Create an identification request

POST https://qa-maksu-api.pivo.fi/api/payments

A successful response contains information about the created payment order.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/api/payments" -d '{"stamp":"a083ca7c-9064-4622-8f1a-d3bab745dcb3","type":"identification","merchant_name":"Pivo Wallet Oy","message":"It be a message.","return_url":"https://yourwebsite.com/callback/return","cancel_url":"https://yourwebsite.com/callback/cancel","reject_url":"https://yourwebsite.com/callback/reject","return_app_url":"yourscheme://api/return"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 4225e27c6e46a9fbec3216e7433e803f5bcb6496235feb0181ca88f1ec4e7f4a

Request body:

{

"stamp": "a083ca7c-9064-4622-8f1a-d3bab745dcb3",

"type": "identification",

"merchant_name": "Pivo Wallet Oy",

"message": "It be a message.",

"return_url": "https://yourwebsite.com/callback/return",

"cancel_url": "https://yourwebsite.com/callback/cancel",

"reject_url": "https://yourwebsite.com/callback/reject",

"return_app_url": "yourscheme://api/return"

}

Response with status 200:

{

"payment_id": "0ac74621b441d6765388b4b2947a464cedcac24f7e3abd581263a59e43fc5e3e",

"stamp": "a083ca7c-9064-4622-8f1a-d3bab745dcb3",

"merchant_name": "Pivo Wallet Oy",

"merchant_webstore_url": "",

"merchant_business_id": "",

"reference": "",

"message": "It be a message.",

"return_app_url": "yourscheme://api/return?payment_id=0ac74621b441d6765388b4b2947a464cedcac24f7e3abd581263a59e43fc5e3e",

"pivo_app_url": "pivo://api/v1/payment_button?payment_id=0ac74621b441d6765388b4b2947a464cedcac24f7e3abd581263a59e43fc5e3e",

"expires_at": 1544613285,

"expired": false,

"type": "identification",

"created_at": "2018-12-12T10:44:45Z",

"updated_at": "2018-12-12T10:44:45Z",

"phone": "",

"phone_status": "received",

"status": "pending",

"url": "",

"location_url": "http://localhost:4000/api/payments/0ac74621b441d6765388b4b2947a464cedcac24f7e3abd581263a59e43fc5e3e",

"return_url": "https://yourwebsite.com/callback/return",

"cancel_url": "https://yourwebsite.com/callback/cancel",

"reject_url": "https://yourwebsite.com/callback/reject"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| stamp | true | String | Your unique identifier for the payment order |

| type | true | String | payment order type: identification |

| merchant_name | true | String | Merchant name. Maximum length is 100 characters. Displayed in Pivo ‘approve authorization’ view. |

| message | false | String | Identification related message for the user. Maximum length is 140 characters. |

| return_url | false | String | Success url. Called automatically by Us to confirm payment transaction. On web payments consumer’s browser is redirected to the url along with payment transaction details. If not provided, web payment is not supported (location_url is defined as blank) and no confirmation is sent. |

| cancel_url | false | String | Used on web payments when consumer cancels the payment order. User’s browser is redirected to the url along with cancellation details. |

| reject_url | false | String | Used on web payments when we cannot help consumer to pay. User’s browser is redirected to the url along with rejection details. |

| return_app_url | false | String | Used to get back to Your application. |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_id | String | Pivo unique identifier for the payment order. |

| stamp | String | Your unique identifier for the payment order |

| merchant_name | String | Name of the merchant |

| merchant_webstore_url | String | Merchant’s web store address |

| merchant_business_id | String | Merchant business id (Y-tunnus) |

| reference | String | Payment’s reference number in standard format (viite) |

| message | String | Payment related message for the user. e.g. Product summary. Maximum length is 140 characters. |

| return_app_url | String | Used to get back to Your application. |

| pivo_app_url | String | Url that You will use to open the Pivo mobile app |

| expires_at | Integer | UNIX time stamp of expiration time (seconds) |

| expired | Boolean | Tells whether the payment order is expired |

| type | String | Payment order type, “payment order” |

| created_at | String | Creation time, ISO-8601 format |

| updated_at | String | Update time, ISO-8601 format |

| phone | String | User’s phone number |

| phone_status | phone status | |

| status | String | Status of the payment order (“pending”, “paid”, “cancelled”, “rejected” or “refunded”) |

| url | String | Generated with call back urls when final state is given |

| location_url | String | web UI location for the payment order |

| return_url | String | Return url |

| cancel_url | String | Cancel url |

| reject_url | String | Reject url |

REST API - Users

Used to fetch User identity information for authorized identification requests.

Access scope: users

To use this resource You need to request a specific access scope when getting access token.

Fetch user identify

GET https://qa-maksu-api.pivo.fi/api/users

Response contains the requested user information

cUrl Example:

$ curl -g "https://qa-maksu-api.pivo.fi/api/users?payment_id=67810cf8c93eee6e2cf8904a3b519938f70eab2a5f1c7e371c7f0a74b1960f99" -X GET \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 536f2734e3d74a7b5150c751ecc052c473a61b3b487f39390afa2dbae62da036

Response with status 200:

{

"user": {

"id": "c40bf777ffd8d5206d8f5901cc39abe6cc45fc6d2f08bc43f51de42c400d9d58",

"ssn": "081181-9984",

"birthday": "08.11.1981",

"sex": "0",

"first_names": "Anna",

"full_name": "Pivo Anna",

"last_name": "Pivo",

"phone_number": "+358442365198"

}

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| payment_id | true | String | Payment Id of the authorized identification request |

Response Fields

| Name | Type | Description |

|---|---|---|

| user | JSON object | User identity information |

| id | String | Unique application and merchant specific user id |

| ssn | String | Social security number |

| birthday | String | Birthday in dd.MM.yyyy format |

| sex | String | User gender (0 = female, 1 = male) |

| first_names | String | First names |

| full_name | String | Full name |

| last_name | String | Last name |

| phone_number | String | Phone number in internation format |

| String | ||

| image_url | String | Image url |

| address | JSON object | Address |

| street | String | Street address |

| post_code | String | Postal code |

| city | String | Postal office |

| country | String | Country |

REST API - PSP Payments

Retrieves Pivo form parameters from psp and creates a payment order.

Supports setting return_app_url for payment order even if payment service provider does not support it.

Access scope: psp_payments

To use this resource You need to request a specific access scope when getting access token.

Create a Payment Order with PSP account

POST https://qa-maksu-api.pivo.fi/psp/payments

A successful response contains information about the created payment order. Merchant specific data is received from the PSP.

Please note that stamp is used as a reference and/or client side identification (With CoF reference gets same value as stamp)

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/psp/payments" -d '{"stamp":"59d9d0157c14ae6f2ae7","psp_account_id":"0edd32d06ced482215760db7f592d3d89b3c4c56634cf1450d7907800ec2398d","amount":350,"message":"It be a message.","return_app_url":"yourscheme://api/return","callback_url":"https://yourwebsite.com/callback","merchant_id":"585858","vat":"24"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer f4d5b4896fd86545b5bf8e0c30faa772637252a0a302004a8e560dc35916b5ff

Request body:

{

"stamp": "59d9d0157c14ae6f2ae7",

"psp_account_id": "0edd32d06ced482215760db7f592d3d89b3c4c56634cf1450d7907800ec2398d",

"amount": 350,

"message": "It be a message.",

"return_app_url": "yourscheme://api/return",

"callback_url": "https://yourwebsite.com/callback",

"merchant_id": "585858",

"vat": "24"

}

Response with status 200:

{

"payment_id": "9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"stamp": "59d9d0157c14ae6f2ae7",

"merchant_name": "Test merchant",

"merchant_webstore_url": "https://example.com/",

"merchant_business_id": "1234567-8",

"message": "Test payment!",

"amount": 100,

"status": "pending",

"pivo_app_url": "pivo://api/v1/payment_button?payment_id=9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"location_url": "http://localhost:4000/api/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"return_app_url": "yourscheme://api/return",

"callback_url": "https://yourwebsite.com/callback"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| stamp | true | String | Your unique identifier for the psp payment order, max length depends on psp implementation (checkout max length 20) |

| psp_account_id | true | String | Unique identifier for your psp account data |

| amount | true | Integer | Amount in euro cents |

| message | false | String | Payment related message for the user. e.g. Product summary. Maximum length is 140 characters. |

| return_app_url | false | String | Used to get back to Your application. |

| callback_url | false | String | Automatic callback url for merchant. |

| merchant_id | false | String | Optional psp merchant_id for psp payment initiation. Merchant id of the shop selling the item (SiS-shop). |

| vat | false | String | Optional vat value for payment. If not provided then 24 is used |

| commission_amount | false | String | Optional commission, requires commission_merchant_id field |

| commission_merchant_id | false | String | Optional commission merchant_id, requires commission_amount field. Merchant ID, that will receive the commission from the payment (usually same as merchant_id) |

| commission_message | false | String | Optional commission message |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_id | String | Pivo unique identifier for the payment order. |

| stamp | String | Your unique identifier for the payment order |

| merchant_name | String | Name of the merchant |

| merchant_webstore_url | String | Merchant’s web store address |

| merchant_business_id | String | Merchant business id (Y-tunnus) |

| message | String | Payment related message for the user. e.g. Product summary. Maximum length is 140 characters. |

| amount | Integer | Amount in euro cents |

| status | String | Status of the created payment order (“pending”, “paid”, “cancelled”, “rejected” or “refunded”) |

| pivo_app_url | String | Url that You will use to open the Pivo mobile app |

| location_url | String | web UI location for the payment order |

| return_app_url | String | Used to get back to Your application. |

| callback_url | String | Automatic callback url for merchant. |

Refund PSP Payment Order with original stamp

POST https://qa-maksu-api.pivo.fi/psp/payments/:payment_id/refund

A successful response contains refund payment status.

⚠ Please note that this API is restricted! For more information please contact us. (access right psp_payments_refund)

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/psp/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843/refund" -d '{"psp_account_id":"73247940f0febce9d3bbe9684c84b5886971ebd9248fdc4cd5bcc817cfd1a1ff","original_stamp":"d8d117ace97bf9655aa3","stamp":"48abd3bdbfcd6afa3c05"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 12ec7f336023922f5f6d2514b8d83214db7f6343c20751846d52ee67f23504ac

Request body:

{

"psp_account_id": "73247940f0febce9d3bbe9684c84b5886971ebd9248fdc4cd5bcc817cfd1a1ff",

"original_stamp": "d8d117ace97bf9655aa3",

"stamp": "48abd3bdbfcd6afa3c05"

}

Response with status 200:

{

"result": "REFUNDED"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| psp_account_id | true | String | Unique identifier for the psp account data |

| amount | false | Integer | Refund amount in euro cents. If omitted the payment is fully refunded. |

| original_stamp | true | String | Your unique identifier for the original psp payment order, max length depends on psp implementation (checkout max length 20) |

| stamp | true | String | Your unique identifier for the psp refund, max length depends on psp implementation (checkout max length 20) |

Response Fields

| Name | Type | Description |

|---|---|---|

| result | String | Status of the refund (“pending”, “paid”, “cancelled”, “rejected” or “refunded”) |

Retrieve a Payment Order for PSP account

POST https://qa-maksu-api.pivo.fi/psp/payments/:payment_id

A successful response contains information about the payment order.

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/psp/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843" -d '{"psp_account_id":"4f086355601be774e4549a4239d20213f012f4123602afb69da30d95fa8ead1d"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 8746e3efa4ce9113e7c03a3faf80225ea2abac40166189f516605d9e2d597559

Request body:

{

"psp_account_id": "4f086355601be774e4549a4239d20213f012f4123602afb69da30d95fa8ead1d"

}

Response with status 200:

{

"payment_id": "9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843",

"status": "paid"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| psp_account_id | true | String | Unique identifier for the psp account data |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_id | String | Pivo unique identifier for the payment order. |

| status | String | Status of the payment order (“pending”, “paid”, “cancelled”, “rejected” or “refunded”) |

Charge PSP Payment Order with charge token

POST https://qa-maksu-api.pivo.fi/psp/payments/:payment_id/charge

A successful response contains payment transaction details.

⚠ Please note that this API is restricted! For more information please contact us. (access right psp_payments_charge)

Typical Error Codes

| Error Code | Message | Meaning |

|---|---|---|

| 400 | Bad request | With body {“payment_method”:“not_supported” } when Pivo user has chosen a Payment Method which is not supported by the Merchant |

| 409 | Conflict | It is possible to call charge only once with the defined charge token. Following requests will end up with conflick http response code. |

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/psp/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843/charge" -d '{"psp_account_id":"6903e70af70a36296a77662b21a7fe9a31e8f9733d3a418b0b5ae9285ad3edfc","charge_token":"fcb43e5d3ccf882ee55d1338c8e1d03ec7c5a02d15e4b0dc7849e66a3e8703ac"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 4f3f582c7763e2f263d73e68643747f3d9774fa5431305334e7564b3773e1a50

Request body:

{

"psp_account_id": "6903e70af70a36296a77662b21a7fe9a31e8f9733d3a418b0b5ae9285ad3edfc",

"charge_token": "fcb43e5d3ccf882ee55d1338c8e1d03ec7c5a02d15e4b0dc7849e66a3e8703ac"

}

Response with status 200:

{

"archive_id": "9543e42ea2a6e5c4dc9d",

"payment_type": "account"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| psp_account_id | true | String | Unique identifier for the psp account data |

| charge_token | true | String | Charge token |

Response Fields

| Name | Type | Description |

|---|---|---|

| payment_type | String | Payment method of the payment transaction. ‘account’: Payment order paid as Bank account transfer, ‘card’: Payment order paid as Card payment, ‘siirto’ Payment order paid as siirto payment. |

| archive_id | String | Payment transaction identification in payment system, ‘arkistointitunnus’. E.g. Bank transfer ‘20170105593497XH0002’ (arkistointitunnus), card payment ‘170125211023’ (filing_code) |

Add phone number to existing payment

PUT https://qa-maksu-api.pivo.fi/psp/payments/:payment_id/phone_number/:phone_number

Used to add phone number to an existing payment order. When You add a phone number to an existing payment order the Payer will receive a push notification referencing to the payment order.

The phone number needs to be in international format (e.g. +358401234567) or local format (e.g. 0401234567).

⚠ Please note that this API is restricted! For more information please contact us. (access right psp_payments_phone_number)

Phone statuses

| phone_status | Explanation |

|---|---|

| received | Phone number is received along with other payment order creation data |

| prosessing | in process (set phone number has called and a Payment notification is sent) |

| ok | Pivo user did not receive push notification |

| push | Pivo user received a push notification |

| siirto | Payment notification was sent to Siirto. |

| accepted | Pivo user was not found, Nor registered device in Siirto, but the created payment order is waiting for user to register with the given phone number. |

| error | Processing failed (Recreating the initiated call might help) |

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/psp/payments/9942a5fa5e872a7cde823ec7b1443519506e99cd31e89ad7d63b4ea793c85843/phone_number/%2B358401234567" -d '{"psp_account_id":"a9b3bc1496ec75cfb0539f679bf428ca151b01c008ea85bd6c96a1673f2e709b"}' -X PUT \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 97d34c8d4b6cd5c2139014d0e626b762f932fa4af66a7180d368890c696b2840

Request body:

{

"psp_account_id": "a9b3bc1496ec75cfb0539f679bf428ca151b01c008ea85bd6c96a1673f2e709b"

}

Response with status 200:

{

"phone_status": "ok"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| psp_account_id | true | String | Unique identifier for the psp account data |

Response Fields

| Name | Type | Description |

|---|---|---|

| phone_status | phone status |

REST API - OP Yrityssiirto

For creating OP Yrityssiirto payments

Please see the section for detailed information when implementing signature calculation.

Dedicated documentation

Dedicated API documentation which only contains Authorization and this section.

Access scope: other_payments

To use this resource You need to request a specific access scope when getting access token.

Typical Error Codes

Error codes 4xx are client errors. On an error, please check Your parameters and access token.

| Error Code | Message | Meaning |

|---|---|---|

| 400 | Bad request | Check Your parameters |

| 401 | Unauthorized | No access token provided or the access token is invalid. Signature is not correct. |

| 403 | Forbidden | The access token does not have proper scope OR we are missing Your account number in provision data |

| 412 | Precondition Failed | Check Your parameters again (e.g. format or business_id) |

| 422 | Unprocessable Entity | Payment unprocessable. User can request more information from payment method provider. |

Create OP Yrityssiirto payment with public key parameter signature

POST https://qa-maksu-api.pivo.fi/other/payments

Response contains archive_number

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/other/payments" -d '{"amount":100,"originator":{"iban":"FI5558498520024222","name":"Iban owner name","business_id":"FI66554436","industry_class_code":"4752"},"beneficiary":{"iban":"FI2159986920069366","name":"Virtanen","first_names":"Oskari Olavi"},"ultimate_originator":{"name":"Korhonen Pekka Tuomas","ssn":"240811-1234","business_id":"24","industrial_class_code":"08"},"message":"Message for receiver","reference":"14932116599460307792","signature":"pk:payment_api_user/ae4c6330abae2d13d646895bc397b0030ed378d0dada0a29907c1e5ae83e0731 jOhd62LYpHLGaunHprdeloEIQutUBVqPjUa3ndZr7Fr1/R2Atwxf6Iow7J6BCHVcj4ZLYPNm91Pp/z85FXEpnze+pTcdfP2yThdVrqniAllDZTvWGArsBZVUVJdxM/NUkxkWvYGTrSoOVhAnZ8Q9VbnvJsK+rEymRK7CCThULRQd9BK1gLWfjfpsKIdliOdT3xr/XUDciJGtnimTJtfvlyt24CwzyQ055UGXTL52eciJYNMYlgBPUZictee8QjGp40epF3AFm6OpYch/G7FEc4aMT8D7DB/zTGsttUGvUSBCrUADyde4WrXnSM4ds9siMoDgdOkKV8/90C61MPs9mQ=="}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization:

Request body:

{

"amount": 100,

"originator": {

"iban": "FI5558498520024222",

"name": "Iban owner name",

"business_id": "FI66554436",

"industry_class_code": "4752"

},

"beneficiary": {

"iban": "FI2159986920069366",

"name": "Virtanen",

"first_names": "Oskari Olavi"

},

"ultimate_originator": {

"name": "Korhonen Pekka Tuomas",

"ssn": "240811-1234",

"business_id": "24",

"industrial_class_code": "08"

},

"message": "Message for receiver",

"reference": "14932116599460307792",

"signature": "pk:payment_api_user/ae4c6330abae2d13d646895bc397b0030ed378d0dada0a29907c1e5ae83e0731 jOhd62LYpHLGaunHprdeloEIQutUBVqPjUa3ndZr7Fr1/R2Atwxf6Iow7J6BCHVcj4ZLYPNm91Pp/z85FXEpnze+pTcdfP2yThdVrqniAllDZTvWGArsBZVUVJdxM/NUkxkWvYGTrSoOVhAnZ8Q9VbnvJsK+rEymRK7CCThULRQd9BK1gLWfjfpsKIdliOdT3xr/XUDciJGtnimTJtfvlyt24CwzyQ055UGXTL52eciJYNMYlgBPUZictee8QjGp40epF3AFm6OpYch/G7FEc4aMT8D7DB/zTGsttUGvUSBCrUADyde4WrXnSM4ds9siMoDgdOkKV8/90C61MPs9mQ=="

}

Response with status 200:

{

"archive_number": "20180119593064010085",

"status": "paid"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| amount | true | Integer | Amount in euro cents |

| originator | true | JSON object | Originator object presenting the payer company |

| originator.iban | true | String | The account number in IBAN format |

| originator.name | true | String | The account owner name |

| originator.business_id | true | String | The business id of the payer company. International format (ALV number). |

| originator.industry_class_code | true | String | The industry class code of the payer company |

| beneficiary | true | JSON object | Beneficiary object presenting the receiver(payee) |

| beneficiary.iban | true | String | The account number in IBAN format |

| beneficiary.name | true | String | The account owner name (person last name or company name) |

| beneficiary.first_names | false | String | The account owner first names (for person, not required for company) |

| ultimate_originator | false | JSON object | Ultimate originator object presenting the party on whose behalf the originator is paying |

| ultimate_originator.name | true | String | The name of the ultimate receiver (for person lastname and firstnames or company name) |

| ultimate_originator.ssn | false | String | The ssn of the person (required for person) |

| ultimate_originator.business_id | false | String | The business_id of the company (required for company). International format (ALV number). |

| ultimate_originator.industrial_class_code | false | String | The industrial_class_code of the company (required for company) |

| message | false | String | message |

| reference | true | String | Payment’s reference number in standard format (viite). If not present ‘message’ is used. |

| signature | true | String | Private key calculated signature from other fields. Use dot-notation for nested elements, order alphabetically and calculate private key signature as presented in Signature section |

Response Fields

| Name | Type | Description |

|---|---|---|

| archive_number | String | Archive number of the created payment |

| status | String | paid |

Create OP Yrityssiirto payment

POST https://qa-maksu-api.pivo.fi/other/payments

Response contains archive_number

cUrl Example:

$ curl "https://qa-maksu-api.pivo.fi/other/payments" -d '{"amount":100,"originator":{"iban":"FI5558498520024222","name":"Iban owner name","business_id":"FI66554436","industry_class_code":"4752"},"beneficiary":{"iban":"FI2159986920069366","name":"Virtanen","first_names":"Oskari Olavi"},"message":"Message for receiver","reference":"14932116599460307792"}' -X POST \

-H "Accept: application/json" \

-H "Content-Type: application/json"

Request Header:

Accept: application/json

Content-Type: application/json

Authorization: Bearer 21a1f772086ddf65fa7020ffc02f95a5294d6059c5f34943eec6edbbf6fb638c

Request body:

{

"amount": 100,

"originator": {

"iban": "FI5558498520024222",

"name": "Iban owner name",

"business_id": "FI66554436",

"industry_class_code": "4752"

},

"beneficiary": {

"iban": "FI2159986920069366",

"name": "Virtanen",

"first_names": "Oskari Olavi"

},

"message": "Message for receiver",

"reference": "14932116599460307792"

}

Response with status 200:

{

"archive_number": "20180119593064010085",

"status": "paid"

}

Query Parameters

| Name | Required | Type | Description |

|---|---|---|---|

| amount | true | Integer | Amount in euro cents |

| originator | true | JSON object | Originator object presenting the payer company |

| originator.iban | true | String | The account number in IBAN format |

| originator.name | true | String | The account owner name |

| originator.business_id | true | String | The business id of the payer company. International format (ALV number). |

| originator.industry_class_code | true | String | The industry class code of the payer company |

| beneficiary | true | JSON object | Beneficiary object presenting the receiver(payee) |

| beneficiary.iban | true | String | The account number in IBAN format |